Lookback option pricing models based on the uncertain fractional-order differential equation with Caputo type | SpringerLink

Lookback option pricing under the double Heston model using a deep learning algorithm | SpringerLink

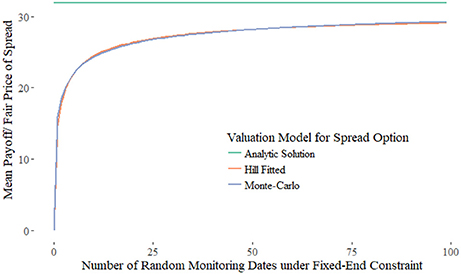

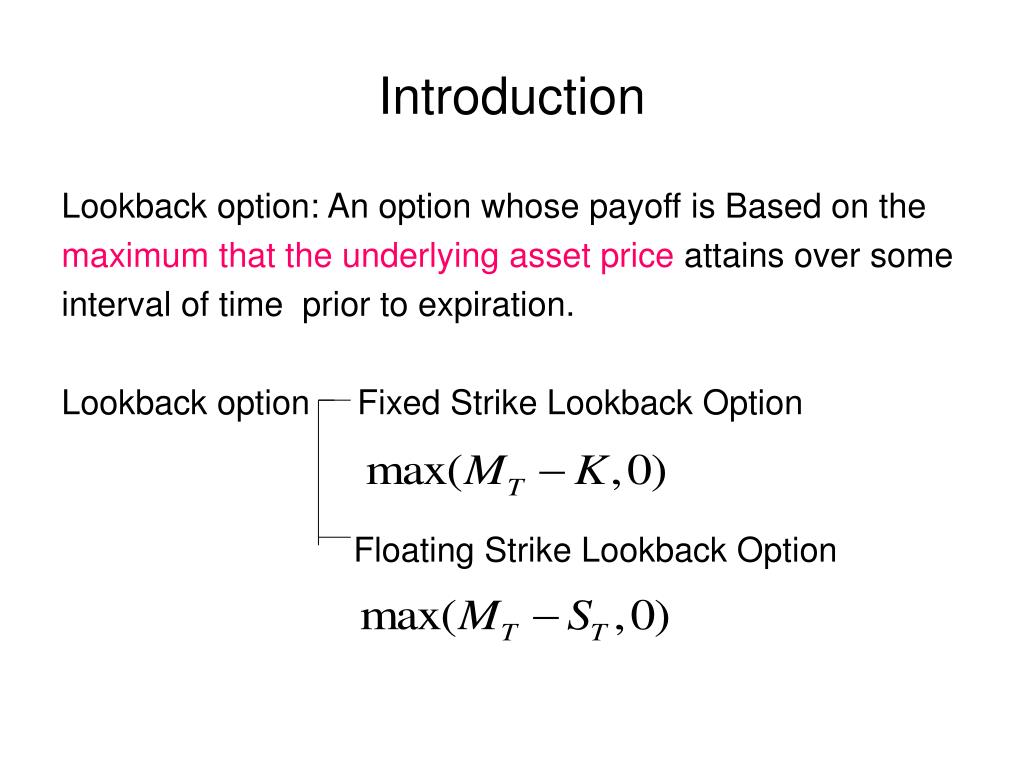

Frontiers | The Amnesiac Lookback Option: Selectively Monitored Lookback Options and Cryptocurrencies

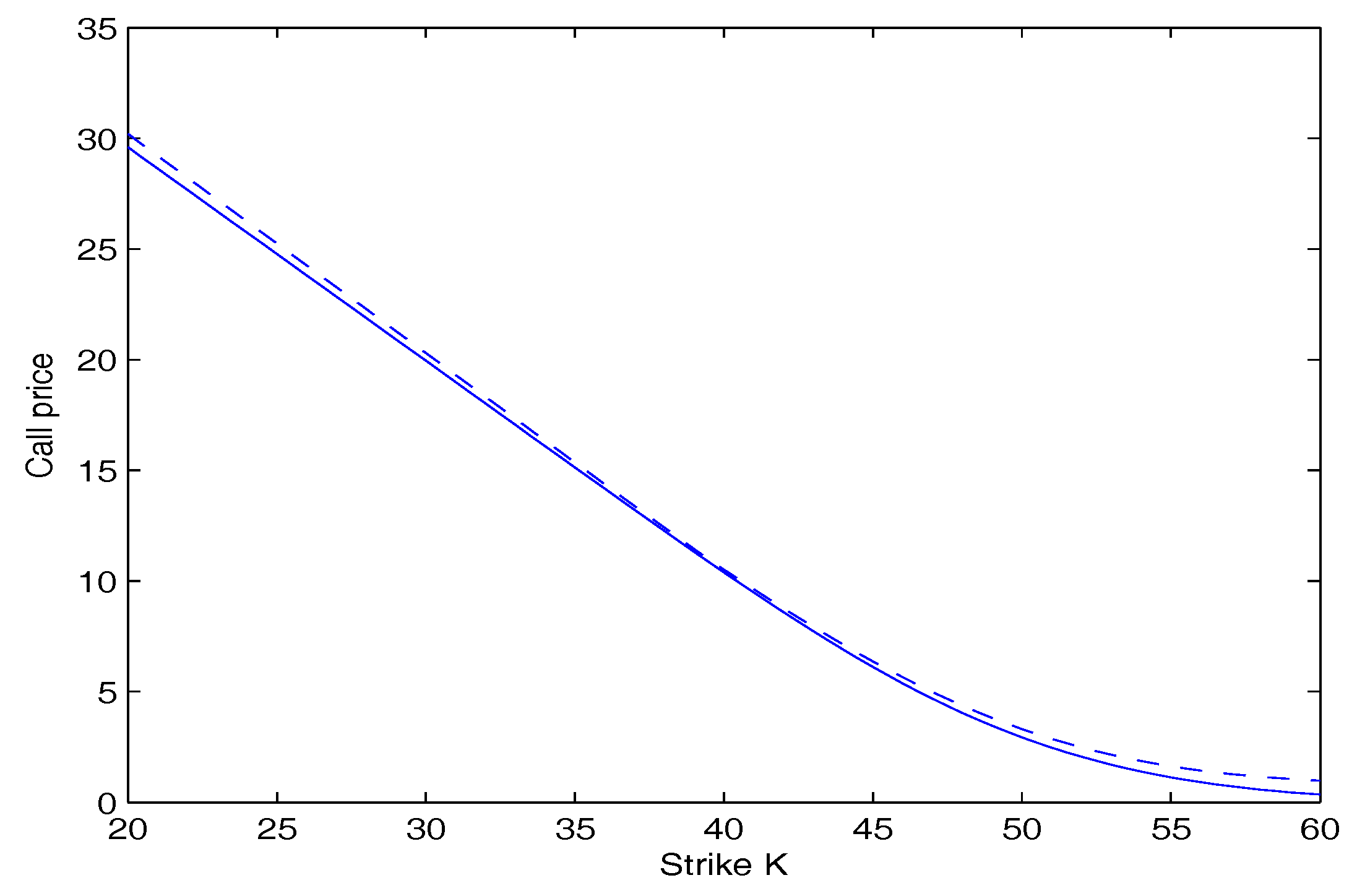

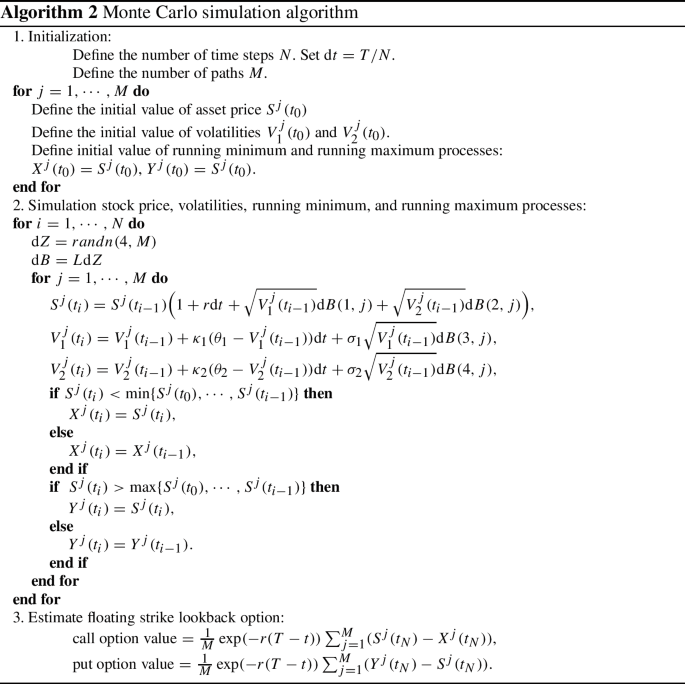

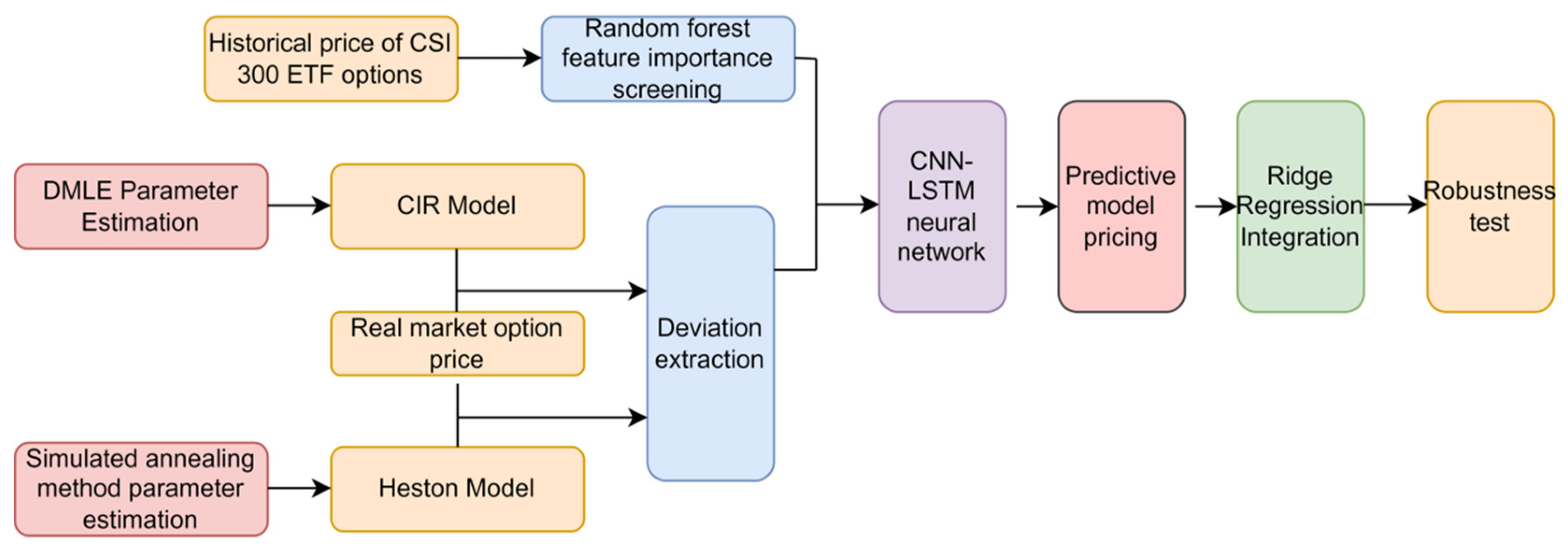

Lookback option pricing under the double Heston model using a deep learning algorithm | SpringerLink

Lookback option pricing under the double Heston model using a deep learning algorithm | SpringerLink

Lookback option pricing under the double Heston model using a deep learning algorithm | SpringerLink

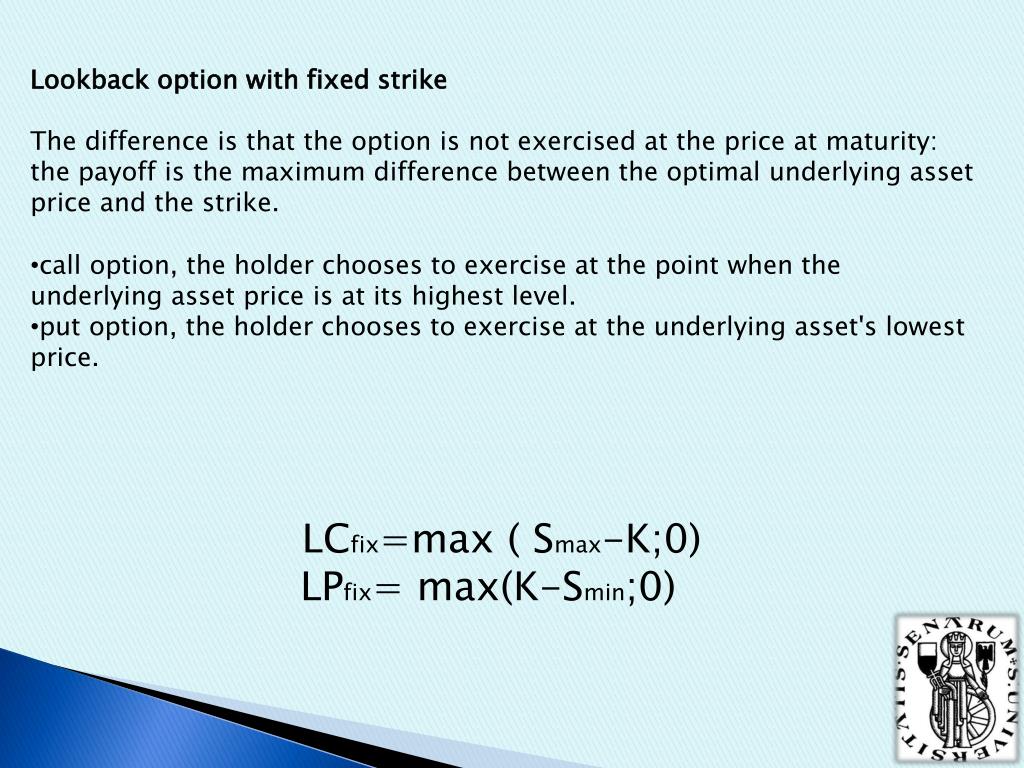

Pricing perpetual American floating strike lookback option under multiscale stochastic volatility model - ScienceDirect

Entropy | Free Full-Text | Non-Gaussian Closed Form Solutions for Geometric Average Asian Options in the Framework of Non-Extensive Statistical Mechanics

Lookback option pricing under the double Heston model using a deep learning algorithm | SpringerLink

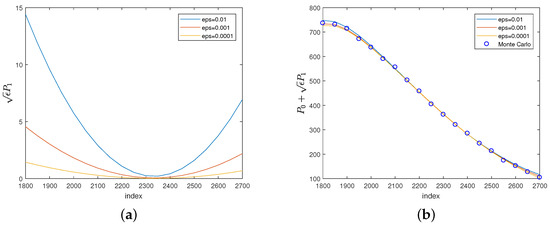

Pricing perpetual American floating strike lookback option under multiscale stochastic volatility model - ScienceDirect

Lookback option pricing under the double Heston model using a deep learning algorithm | SpringerLink

Figure 9 from The Amnesiac Lookback Option: Selectively Monitored Lookback Options and Cryptocurrencies | Semantic Scholar

JRFM | Free Full-Text | Pricing Path-Dependent Options under Stochastic Volatility via Mellin Transform

![PDF] Equivalence of floating and fixed strike Asian and lookback options | Semantic Scholar PDF] Equivalence of floating and fixed strike Asian and lookback options | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/f0adb51195e9be6354a4f2cdcbe4838cc97b24f8/4-Table2.1-1.png)